On September 17, 2025, the Federal Reserve is widely expected to cut its short-term rate. Many homeowners are holding off on refinancing, hoping that means lower mortgage rates.

But here’s the truth: Mortgage rates don’t move in lockstep with the Fed’s rate.

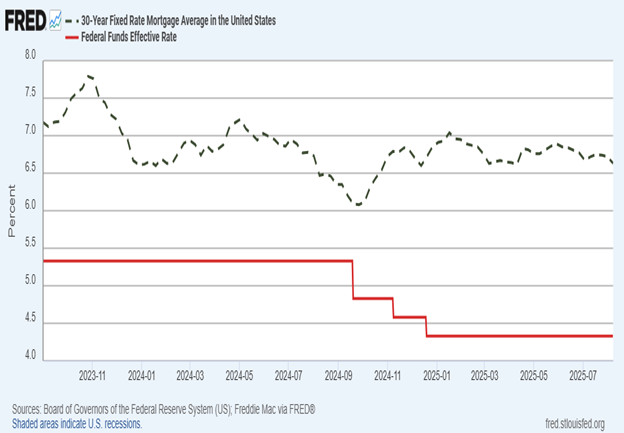

The red line in the graph above reflects the Fed’s short-term rate (impacting credit cards, auto loans, and other short-term borrowing). The green dashed line is the 30-year fixed mortgage rate from Freddie Mac. Notice what happened in September 2024—the Fed cut rates, but mortgage rates went up shortly afterward.

Why? Because mortgage rates are based on the bond market and investor expectations about inflation and the economy—not just the Fed’s announcement. That rate cut signaled to investors that inflation might stick around longer, so they sold bonds, pushing mortgage rates higher.

Last year, a homeowner with a $400,000 mortgage at 7.25% could have refinanced to 6.25% before the Fed cut rates. They didn’t. Their payment stayed at $2,729 instead of dropping to $2,462—a $266 monthly savings missed.

Over the last 12 months, they paid $3,190 more than they needed to. That’s far more than the cost of a refinance, which would have given them immediate savings.

If you’re waiting for the Fed meeting to see what happens, you could miss the best window. Opportunities often appear before the announcement—and disappear right after.

Here’s what we know:

At Williams Mortgage LLC, our job is to give you the information and options to make the best decision for your situation. But we can’t make the choice for you.

If rates drop after the Fed meeting, you win. But if they jump—as they did last year—you could end up paying thousands more over the next year.

The safe move? Get the facts, know your options, and consider acting before September 17.

📞 Contact us today to review your refinance options—before the window closes.